Please Scroll Down for Current & New Issues FD Bonds NCD & Other Bonds

Latest FD Rates for – HDFC, ICICI HFL, Bajaj Finance, LIC HFL & Mahindra & Mahindra – Click (01 Dec 2022)

Corporate FD Rates (Updated 19/11/2022)

New NCD Issue

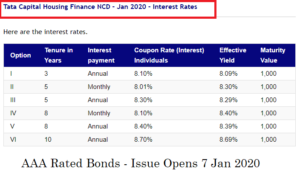

TATA Capital Housing Finance NCD (Closed)

Issue start date: 7-Jan-2020

Issue end date: 17-Jan-2020

NCD’s are available in 6 options. It offers NCD for 3 years, 5 years, 8 years and 10 year tenure.

Coupon interest rates are between 8.01% to 8.7%.

Series 1 to 5 are secured NCD and Series 6 is unsecured NCDs.

Interest payable monthly or yearly depending on the NCD chosen.

The face value of the NCD bond is Rs 1000.

Minimum investment is for the 10 bonds. Means, you need to invest for a minimum of Rs 10,000. Beyond this you can invest in multiples of 1 bond.

These NCD bonds would be listed on BSE/NSE. Hence, these are liquid investments.

Rates:

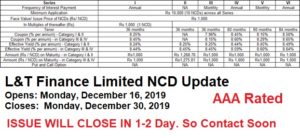

L&T Finance Limited NCD (Closed)

Opens: Monday, December 16, 2019

Closes: Monday, December 30, 2019

Allotment: First Come First Serve Basis

Nature of Instrument: Secured Redeemable Non-Convertible Debentures

Minimum Application: ₹ 10,000 (10 NCD)

Listing: BSE/ NSE

Rating: CRISIL AAA/Stable, CARE AAA / Stable, IND AAA / Stable