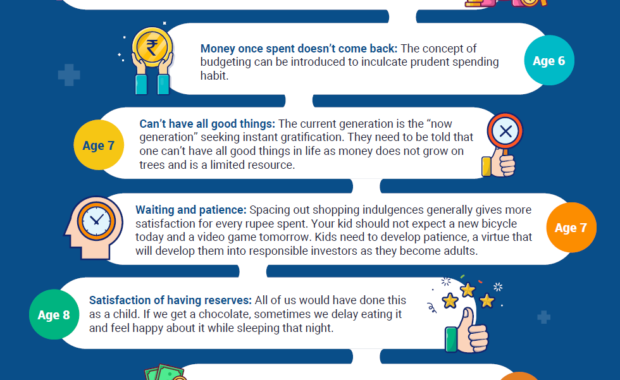

आज के बच्चे कल का भविष्य है और कल का भविष्य संवारने के लिए आज किया गया निवेश सर्वोत्तम है। हर साल 14 नवंबर को हम बाल दिवस के रूप में मनाते हैं और इस दिवस को मनाने की सार्थकता तभी है जब हम देश के बच्चों की बेहतरी के लिए कुछ कर सके। बच्चों को एक सुदृढ़ भविष्य देना हमारी पीढ़ी की प्रमुख जिम्मेदारियों में से एक है, अतः उनके सुंदर भविष्य के लिए उनकी वित्तीय नींव मजबूत करना आज बेहद जरूरी है। इस अवसर पर यूटीआई चिल्ड्रन कैरियर फंड को आपके बच्चों के बेहतर भविष्य के एक विकल्प के रूप में लेकर प्रस्तुत है। आप एक अभिभावक के रूप में अपने बच्चों के लिए एसआईपी अथवा एकमुश्त निवेश के माध्यम से इस बाल दिवस को

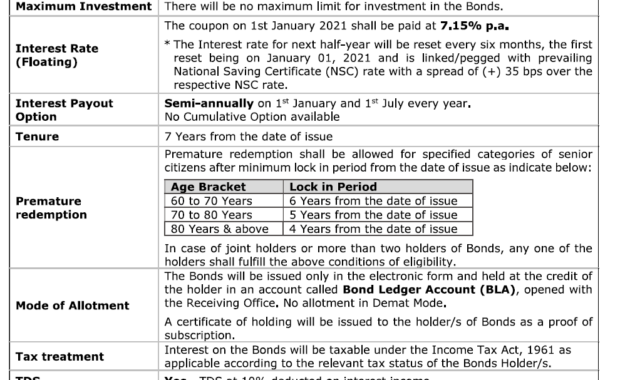

New RBI 7.15% Floating Rate Savings Bond

Government made amendments to Personal Finance Investors. They had closed RBI bonds on a Saturday, just giving half-day (Monday) to build panic among fixed-income investors. And almost a month after they have launched the improvised version – RBI 7.15% Floating Rate Savings Bonds 2020. These RBI Bonds start for subscription from July 01, 2020. What are the features of RBI Floating Rate Savings Bonds? Should you invest? What is “Floating” in RBI 7.15% Floating Rate Savings Bonds? Who can invest? Let see in today’s post: RBI 7.15% Floating Rate Savings Bonds 2020 These bonds have been

P2P Lending – P2P Borrowing

P2P - Peer To Peer is a New way of Investing Money & Borrowing Money P2P Lending (Investments) - Details Here Start Lending with FAIRCENT Start Lending with FINZY P2P Loans (Borrowing) - Details Here Take a Loan From FAIRCENT Take a Loan From FINZY

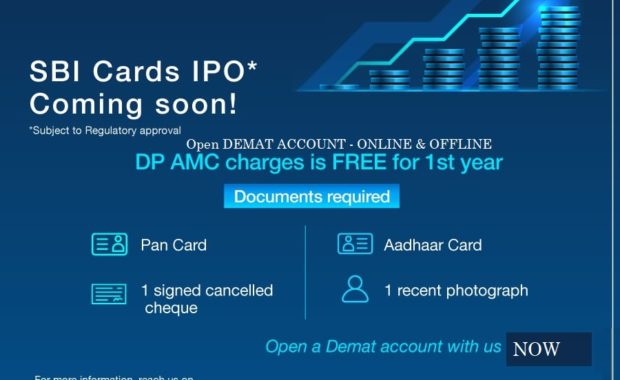

SBI Cards IPO – Issue details

SBI Cards IPO – Issue details & FAQs of the IPO IPO opening date: 2-March-2020 IPO closure date: 5-March-2020 (Last day 5th March - only Retail & HNI can bid) Face Value: Rs 10 per share Issue price band: Rs 750 to Rs 755 per share (approx. final price yet to be announced) Issue size: 9,000 Crores approx. IPO Lot size: Yet to be announced Minimum investment: Yet to be announced DEMAT - compulsory

Latest HDFC LTD FD Rates

Here is latest chart of HDFC FD Rates. Updated 01 June 2020. Latest HDFC FD Rates Apply Now HDFC is a leading provider of Housing Finance in India. With our customised solutions we have fulfilled over 7 million dreams since inception. Pioneered Housing Finance in 1977. Cumulative units housing units financed: 7 million Gross loans stood atRs.4.6 trillion About 1.9 million Deposits Accounts A model private Housing Finance Company for developing countries with nascent Housing Finance markets. Undertaken several consultancy assignments in

Bharat Bond ETF

Bharat Bond ETF New Fund Offer Bharat Bond NFO is closed. It Will Opens for Buying & Selling from 2 Jan 2020. Complete Details, Taxation, Portfolio & Feature of Bharat Bond ETF (Click Here To Apply) Bharat Bond is a pure Debt Fund. Its equity counterpart is Bharat 22 Fund. Bharat Bond ETF is proposed to start on 12 Dec 2019. It will have 2 schemes – a 3 Year ending 1 April 2023 & a 10 year variant with maturity on 1 April 2030. There is no entry load to invest. Also, there is no exit load or lock-in period. Bharat Bond ETF is an Index Fund so both options will

NFO – Axis Retirement Fund

Launching Axis Retirement Fund Fund Name "Axis Retirement Fund" NFO Period: 29th Nov - 13th Dec 2019 About the Fund Solution-Oriented Product aimed at investing for one’s retirement Selection and Allocation Open-ended fund with 3 Plans: Aggressive, Dynamic & Conservative Fund Traits Retirement Planning Stock Selection Criteria SIP Benefits Apply Now Mutual Funds Investments Online Mutual Fund Account New Mutual Fund Offers (NFO) National Pension Scheme (NPS) Apply IPO Open Demat & Trading Account

Fixed Deposit Rates – Updated

Fixed Deposits had been used to get regular incomes. Follow this space for updated information on FDs / Bonds & NCDs (Non-Convertible Debentures) Click Here We Also Deal in DEBT Mutual Funds Click Here to Apply Open Online Mutual Fund Account

NFO – TATA Focused Equity Fund

Launching Tata Focused Equity Fund Select Right, Swing Hard Fund Name" TATA Focused Equity Fund NFO period: 15th November'19 - 29th November 2019 (Fund Open Now for Buying & Selling Units) Fund Manager: Rupesh Patel Benchmark: S&P BSE 200 TRI About the fund High conviction ideas with meaningful allocation. A concentrated portfolio of not more than 30 stocks. Selection and Allocation Selecting the dream team and positioning the players both are crucial to a winning game. Imagine the Top Batsmen going in when the team is out of overs. Or the best bowlers being overlooked while