The National Pension System or scheme known as NPS started with the decision of the Government of India to stop defined benefit pensions for all its employees who joined after 1 January 2004. While the scheme was initially designed for government employees only, it was opened up for all citizens of India in 2009.

TriWealth India is the First and Only, PFRDA Authorised Retirement Advisor in Rajasthan, to market, distribute & open NPS accounts. We are licensed by PFRDA till 24, Aug 2024 under License No RAN000004201 (in name of Mr Madhupam Krishna – SEBI Reg Financial Advisor).

TriWealth India is the First and Only, PFRDA Authorised Retirement Advisor in Rajasthan, to market, distribute & open NPS accounts. We are licensed by PFRDA till 24, Aug 2024 under License No RAN000004201 (in name of Mr Madhupam Krishna – SEBI Reg Financial Advisor).

Click for NPS Presentation Updated till Feb 2020.

Open NPS Account Now (Complete Online Process)

What is NPS?

The National Pension System (NPS) is a voluntary defined contribution pension system administered and regulated by the Pension Fund Regulatory and Development Authority (PFRDA), created by an Act of the Parliament of India.

There are two types of NPS accounts — Tier-I and Tier-II.

While Tier-I account is for retirement purpose and matures when the contributor retires at the age of 60, there is no such restrictions or withdrawals in Tier-II accounts.

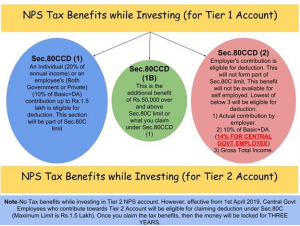

Contributions to Tier-I accounts qualify for tax deductions u/s 80CCD up to Rs 50,000 in a financial year, which is over an above the Rs 1,50,000 investment limit u/s 80C.

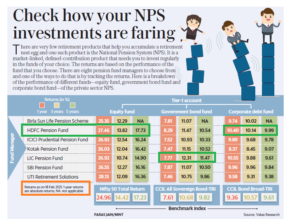

At present, there are 8 fund managers who manage your money. (check their returns below)

Like a pension scheme, you contribute during the time you earn. At the time of retirement, you can ask the Pension Manager to provide you returns via pension.

Click for NPS Presentation Updated till Feb 2020.

NPS Eligibility

Any citizen of India-resident or Non-resident, in the group of 18 to 60 years can open NPS account. Permanent Retirement Account Number (PRAN) will be issued to individuals registered under NPS.

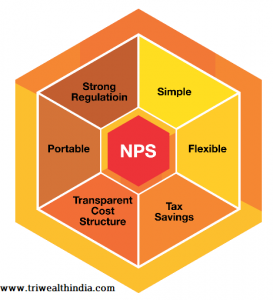

Benefits of Investing in NPS

|

|

NPS Tax Savings & Benefits

NPS returns (As on 18 Feb 2021)

(Vs PPF Rate 7.10% PA, EPFO Rate 8.65% PA as on 01 Feb 2021)

Contact Us – For Latest NPS Returns Chart

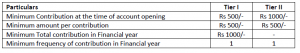

NPS Minimum Contribution

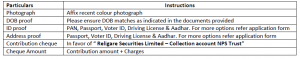

NPS Documents

Why Choose TriWealth for NPS?

We are not just NPS distributors but advisors also. We are authorized to advise on National Pension Scheme and help subscribers to take benefits of NPS.

We provide complete Pre & Post Sale Services. Open NPS Account Now (Complete Online Process)