TriWealth India brings P2P Lending & P2P Borrowing to Rajasthan!

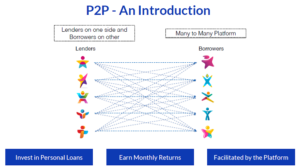

What is Peer 2 Peer (P2P) Lending?

Any Indian resident, with an age of 18 years or above with a valid bank account and PAN card can lend on P2P Platforms provided by TriWealthIndia.

All P2P Platforms & companies are RBI listed finance companies or Companies formed under the Indian Companies Act are also eligible to apply as Lenders.

You can start by investing from Rs. 500/- per loan. Borrowers are registered on the website for a loan period ranging from 6 – 36 months. You can choose the Borrower according to the loan period that suits you.

Returns depend on the credentials of borrowers and the ongoing demand for lenders in the marketplace. We have an automated system, which assigns a rate of interest to each borrower. It ranges between 12% to 28%. Returns depend on how a lender spreads his investment.

TriWealth India is Partner with 2 Biggest P2P Platforms for Lending Business. These are Faircent & Finzy.

Check How P2P Lending can benefit you – TriWealth – Finzy Site

|

|

| Start Lending with FAIRCENT | Start Lending with FINZY |

What is Peer to Peer (P2P) Loans?

TriWealth India provides a unique opportunity to help borrowers get loans at a better rate of interest and in the process help Lenders earn a higher interest rate than what they would if they kept their money idle. The process is mutually beneficial and is a win-win situation for both parties. However, please read the Terms and Conditions to understand the risk involved.

In case you require short term loans (3 Months to 36 Months) for Personal Use, Purchase of Commercial Appliances, Paying Credit Card, Medical Emergency, Home Improvement or reasons like this – You can apply loan through our platform.

Other P2P Loans available are:

- Personal Loans

- Salaried only Loans

- Premium Salaried Loans

- Education Loan

- Atamnirbhar Loans

- Small Business Funding

- Loans for Woman Only

- COVID 19 Loans

- Commercial Loans

TriWealth India is Partner with 2 Biggest P2P Platforms for Borrowing or Loan Business. These are Faircent & Finzy.

|

|

| Take a Loan From FAIRCENT | Take a Loan From FINZY |