What is PMS?

PMS or Portfolio Management Services is an investment portfolio in Stocks, Debt and fixed income products managed by a professional money manager, that can potentially be tailored to meet specific investment objectives.

When you invest in PMS, you own individual securities unlike a mutual fund investor, who owns units of the entire fund. You have the freedom and flexibility to tailor your portfolio to address personal preferences and financial goals. Although portfolio managers may oversee hundreds of portfolios, your account may be unique.

Who can offer PMS?

As per SEBI guidelines, only those entities who are registered with SEBI for providing PMS services can offer PMS to clients. The minimum amount to subscribe is Rs 50 Lakhs.

What are the operational formalities for opening a PMS account?

The customer needs to sign the following documents for opening a PMS account

– PMS agreement with the provider

– Power of Attorney agreement

– New demat account opening form

– PAN, address proof and Identity proofs

Additional Documents for NRIs to open PMS Account

Photocopy of passport -self-attested

• Photocopy of valid visa/work permit -self-attested

• Pan Card copy (Mandatory for NRE PIS/NRO PIS accounts-self attested )

• Address proof -self-attested.

• At least one document provided has to be in English apart from passport

A PMS account becomes operational in 7-10 working days time frame.

What are the charges in a PMS ?

Entry Load – PMS schemes may have an entry load from 03%. It is charged at the time of buying the PMS only.

Management Charges – Every PMS scheme charges Fund Management charges. Fund Management Charges may vary from 1%-3% depending upon the PMS provider. It is charged on a quarterly basis to the PMS account.

Profit Sharing – Some PMS schemes also have profit sharing arrangements, wherein the provider charges a certain amount of fees/profit over the stipulated return generated in the fund. For Eg PMS X charges 20% of fees for return generated above 15% in the year. In this case, if the return generated in the year by the scheme is 25%, the fees charged by the PMS will be 2%{(25%15%)*20%}.

The Fees charged is different for every PMS provider and for every scheme. It is advisable for the investor to check the charges of the scheme with us. Call Now for Appointment.

How many types of PMS are there?

There are broadly two types of PMS

1. Discretionary PMS – Where the investment is at the discretion of the fund manager & client has no intervention in the investment process.

2. NonDiscretionary PMS – Under this service, the portfolio manager only suggests investment ideas. The choice, as well as the timings of the investment decisions, rest solely with the investor. However, the execution of the trade is done by the portfolio manager.

The client may give a negative list of stocks in a discretionary PMS at the time of opening his account and the Fund Manager would ensure that those stocks are not bought in his portfolio. Majority of PMS providers in India offer Discretionary Services.

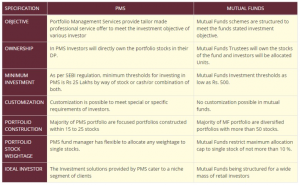

What is the difference between a Mutual Fund & PMS?

TriWealth – A Complete PMS Provider

We research & deal in more than 100 PMS schemes of India. We analyze PMS based on Investment Strategy & Horizon of investment. Some of the PMS that we advise are:

- Motilal Oswal PMS

- Ambit Capital

- ASK

- Marcellus

- Old Bridge

- IIFL

- Kotak

- DSP

- Unity & Many More

Call Now for Appointment